Life Insurance Plans & Policies in India

A life insurance plan is a contract between the life insurance company and the policyholder in which the company promises to pay a pre-determined sum amount to the nominee in case of the death of the policyholder or after the maturity of the policy. In return, the assured need to pay a premium amount for a certain time. A life insurance policy ensures the financial security of the family of the assured in case of an unforeseen event. Some life insurance companies in India also offer optional rider coverage, such as accidental riders, critical illness riders, etc.

The benefits of buying a life insurance policy are more than just providing financial security to the insured's family. A life insurance policy can help individuals to get tax benefits on the life insurance premiums paid and also avails multiple benefits received under the life insurance policy. A life insurance plan can be used as collateral for a loan. Hence, we cannot ignore the importance of life insurance in ensuring the financial security of loved ones.

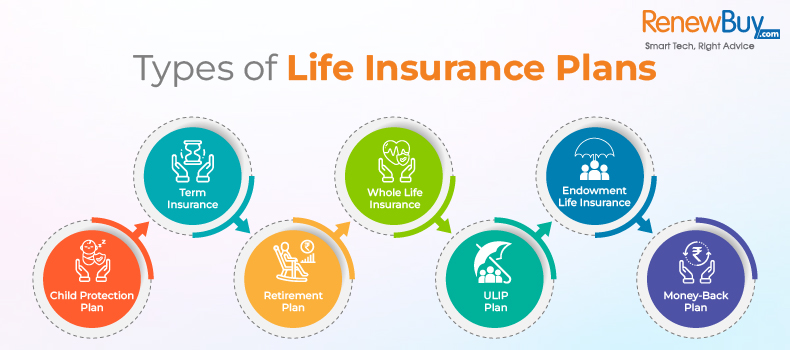

Types of Life Insurance Plans

There are various types of life insurance available in India. The following are the different types of life insurance plans available in India:

Term Insurance

Term insurance is the most simple and basic type of life insurance plan. It is also known as a "pure protection plan". A term insurance plan provides a death benefit to the policy's nominee/beneficiary if the life assured dies suddenly during the policy term. This type of plan provides financial security to the family and loved ones in case of the absence of the policyholder.

Whole Life Insurance

Whole life insurance remains active till the policyholder is alive (up to 100 years of age). If the policyholder dies during the policy term, the insurer pays the sum assured under whole life insurance to the nominee of the policy. If the policyholder survives till the age of 100 years, the insurer pays the matured endowment coverage to the policyholder in the form of maturity benefit.

Endowment Life Insurance

Endowment plans are also known as traditional life insurance plans. It is a combination of savings and a life insurance plan. An endowment plan helps the policyholder to save his fund regularly to get the lump sum amount on the maturity of the policy. This maturity benefit is paid to the insured if they survive the entire policy tenure. In case of demise of the life assured during the policy term, the life insurance company provides the sum assured to the beneficiary as the death benefit of the policy.

Child Protection Plan

A child insurance plan is a combination of life cover and investment plan. It secures multiple stages of your child’s future. The plan offers a lump sum amount at the end of the policy term and this amount can be used for your child's education and marriage.

Retirement Plan

The retirement plan is also known as a pension plan. It is a combination of investment and life insurance plans. A retirement plan or pension plan helps you to secure your post-retirement life financially. This plan helps you to get regular income even after retirement and helps you to become financially independent to enjoy post-retirement life.

ULIP Plan

The unit-linked investment plan is a combination of an investment and life insurance plan. This plan is specially designed for wealth creation and life protection. This plan invests your money in market-linked funds (stocks, bonds, mutual funds, etc). Generally, ULIP plans are flexible and transparent allowing you to customize your plan as per your needs and requirements.

Money-Back Plan

The money back plan is a combination of both insurance and an investment plan. Under money back plan, the policyholder gets regular payouts every 5 years as a survival benefit. These regular payments are usually equal to some percentage of the sum assured amount.

Savings & Investment Plan

The savings and investment plan is the best life insurance plan that channelizes your regular savings into safe and secure long-term investment returns. Under this plan, you can expect to get guaranteed maturity benefits along with a life cover. This plan covers both traditional and ULIPs so you can plan your short-term and long-term future expenses. As an additional benefit, these plans allow you to save on taxes.

Group Life Insurance Plan

A group life insurance plan is another type of life insurance that is eligible for a group of people in the same contract irrespective of their age, gender, occupation, or social/economical status. Generally, group insurance is preferred by organizations where employer prefers to cover all their employees under a single plan from the day of their joining to the day of resignation. This master life insurance plan covers every individual in the group, their children, and their dependent parents.

Comparisons of Life Insurance Plans in India 2024

| Basis | Whole Life Insurance | Term Insurance | Endowment Plan | Unit Linked Investment Plan (ULIP) | Pension/Annuity Plan | Term Return of Premium (TROP) |

|---|---|---|---|---|---|---|

| Overview | Life protection for 100 years | Life Cover for a specific duration against a fixed premium amount | Combination of Protection + Guaranteed returns | Combination of Protection + Investment | Regular pension for post-retirement life | Premiums paid are refunded at the end of the Policy Term |

| Policy Tenure (in Years) | Till 100 years | 5-85 years | 5-35 years | 10-20 years | Whole Life | 5-65 years |

| Maturity Benefits | Available when you turn 100 years old | Not available | Available | Available | Regular Income after retirement | Survival Benefits on Maturity |

| Death Beneficiary | Life Cover | Life Cover | Sum Assured | Sum Assured | Not Available | Sum Assured |

How Does Life Insurance Work?

Life insurance is a contract between the policyholder and the insurance company in which the insurance company promises to pay a lump sum amount to the policyholder or nominee. Life Insurance policies help achieve long-term financial goals and provide financial protection to your loved ones when you are not around. Life insurance policies are versatile in nature as they help achieve numerous financial objectives. Below are some of the goals:

- Financial protection of the family

- Buying a House

- Education for Children

- Post-retirement pension

- Child’s Marriage

Why is Life Insurance Important?

Life insurance is important because it provides financial protection and support to your loved ones during your unexpected death. Life insurance can help your family pay for final expenses, such as funeral costs, and provide a source of income to replace your lost earnings. It can also be used to pay off debts, such as a mortgage or car loan, and cover ongoing expenses like childcare or tuition fees.

Having life insurance can give you peace of mind knowing that your loved ones will be cared for financially, even if you are no longer there to provide for them. Additionally, some life insurance policies can accumulate cash value over time, which can be used to supplement retirement income or pay for other expenses.

Life insurance is particularly important for individuals who have dependents, such as children or a spouse, who rely on their income to cover basic living expenses. It can also benefit business owners who want to ensure the continued operation of their business after their passing.

Reasons Why Life Insurance is Important?

Life insurance provides financial protection and stability to your loved ones during a difficult time. It helps ensure that they can maintain their lifestyle, cover expenses, and achieve their long-term goals, even in your absence. Life insurance is important for several reasons:

-

Financial Protection for Loved Ones

Life insurance provides a financial safety net for your loved ones during your untimely death. It can help cover expenses such as funeral costs, outstanding debts (e.g., mortgages, loans), daily living expenses, and education costs for children.

-

Income Replacement

If you are the primary breadwinner in your family, life insurance can replace the income you would have provided. This ensures that your family can maintain their standard of living and meet their financial obligations even after you're gone.

-

Debt Repayment

Life insurance can help settle any outstanding debts or loans you leave behind, such as mortgages, car loans, or credit card debt. Without life insurance, your loved ones may be burdened with these financial obligations.

-

Estate Planning

Life insurance can play a vital role in estate planning. It can provide liquidity to cover estate taxes, legal fees, and other expenses of transferring assets to your beneficiaries.

-

Business Continuation

Life insurance can be crucial for business continuity if you own a business. It can be used to fund a buy-sell agreement, ensuring a smooth ownership transition in the event of your death. Life insurance can also help cover any outstanding business debts or provide funds to keep the business running during a challenging time.

-

Peace of Mind

Having life insurance offers peace of mind, knowing that your loved ones will be financially protected if something happens to you. It provides a sense of security, allowing you to focus on other aspects of life without worrying about the financial well-being of your family.

-

Affordability in Youth

Life insurance tends to be more affordable when you're young and healthy. Securing a policy early can help you lock in lower premiums and ensure long-term coverage.

-

Cash Value Component

Certain types of life insurance, such as whole life or universal life insurance, build cash value over time. This cash value can be accessed or borrowed during your lifetime for various purposes, such as supplementing retirement income or funding emergencies.

-

Charitable Contributions

Life insurance can be used as a tool for charitable giving. You can name a charitable organization as the beneficiary of your policy, ensuring that your philanthropic goals are fulfilled even after you're gone.

-

Final Expenses

Life insurance can cover the costs associated with your funeral and other final expenses. It relieves your loved ones from the financial burden of arranging and paying for these services.

Key Features of Life Insurance Policy in India

Life is uncertain and the only way to deal with this uncertainty is to be prepared for them. To avoid such uncertainties, you can buy a life insurance policy that provides financial protection to your family and your loved ones in your absence. A life insurance plan is not just a tool that provides financial protection, it has many other features that one needs to understand before buying a life insurance policy in India. Below mentioned are the key features of the life insurance policy in India:

Death Benefits

In case of an untimely death of the life assured during the policy term, the nominee will receive a death benefit, which will help your financial dependents to fulfill their daily needs and life goals.

Investment option

A life insurance policy can be used as an investment option, if you invest in ULIPs, Endowment and Money Back plan as these type of life plans provide dual benefits of life cover and investment.

Tax Exemption

You can also save your income tax with the help of a life insurance policy. Under sections 80C and 10(10D) of the Income Tax Act, 1961, you can avail of income tax benefits of buying a life insurance policy.

Flexibility in payments of the premium

A life insurance policy offers flexibility in premium payment. You can pay your life plan premiums on a monthly, quarterly, half-yearly, or yearly basis. You can choose your premium payment mode and frequency under the life insurance plan.

Maturity Benefits

Life insurance policies offer maturity benefits if the policyholder survives the policy term. The life insurance company will provide a sum assured to the policyholder as a maturity benefit at the end of the policy tenure.

Collateral for Loan

Some life insurance policies offer a loan against a policy facility that can help the policyholder meet immediate financial needs, such as medical bills or loan repayment, etc.

Optional Riders

With the life insurance plan, the policyholder may get a chance to get the optional rider benefits which significantly work as the top-up plan. This includes accidental death benefits, critical illness coverage, partial disability, or complete disability benefits. Optional riders are totally elective by the policyholder and allow to choose single or multiple benefits.

Nominee of Choice

When purchasing a policy, the policyholder is allowed to select the nominee of his/her choice. It solely depends upon the policyholders whether they want to make their family member a nominee or not. The nominee will get the policy benefits if the policyholder is demised during the premium tenure.

Assured Income

Life insurance covers a long and short-term income facility for you or your loved ones after your uncertain demise. This helps in reducing liability burdens and covers any illness or critical circumstances.

Benefits of Life Insurance policy

Whether you want to secure your future with ample savings or wish to protect your family during the rough phases of life, a life insurance policy is the best asset for you. A well-planned life insurance policy provides financial protection to the family in case of the sudden death of the policyholder. It helps the policyholder to financially secure the future of their loved ones and also gives them a way to save their earnings for a better future. There are various benefits of buying a life insurance policy in India. Below mentioned are the benefits of buying a life insurance plan in India:

Plan at a young age, relish in old age

The earlier you plan to get life insurance, the lesser you need to pay the premiums. Also, if you are planning a stable and stress-free future, life insurance becomes more essential.

Strong Financial Protection

Life insurance provides financial protection to loved ones. Life insurance act as a financial shield for the family of the policyholder

Gain a financially stable future

A life insurance policy can help in securing the financial security of your loved ones in the future. A life insurance plan pays a death benefit to the nominee in the event of the death of the insured, which can help the family to clear debt or other responsibilities and maintain their standard of living.

Plan a stress-free post-retirement life

Life Insurance policy can be very useful at the time of your retirement and provides you financial support and makes you financially independent post-retirement.

Save on Taxes

Section 80C of the Income Tax Act allows you to deduct up to Rs. 1.5 lakh in life insurance premium. Additionally, if the premium is up to 10% of the sum assured or the sum assured is at least 10 times the premium amount of the life insurance plan, then the income is eligible for tax exemption under section 10(10D).

Best to reduce your loan burden

A life insurance policy allows you to take a loan at a low-interest rate to meet immediate financial expenses. With the help of a life insurance plan, the assured can enjoy a substantial amount of liquidity. You can avail of loan facilities by investing in ULIPs, endowment plans, and child plans.

Securing your child's future

If properly planned, life insurance can provide you and your child with many benefits at different stages of life. Whether you dream of the best education for your child or set competitive future goals, you achieve it all.

Best Life Insurance policy in India 2024

Buying a life insurance policy can be a daunting task for the customers as many life insurance companies are offering various life insurance plans in India. We "RenewBuy" have done some extensive research and made a list of "Best Life Insurance Policy in India". The table below lists the best life insurance policy in India.

| S.no. | Company name | Plan Name | Plan type | Max. Sum Assured |

|---|---|---|---|---|

| 01 | HDFC Life Insurance | Click 2 Protect Life | Term Insurance | No Limit |

| 02 | Axis Max Life insurance | Smart Secure Plus | Term Insurance | 1Cr |

| 03 | ICICI Pru Life Insurance | iProtect Smart | Term Insurance | No Limit |

| 04 | Bajaj Allianz Life Insurance | Smart Protect Goal | Term Insurance | 1Cr |

| 05 | Edelweiss Tokio Life Insurance | Simply Protect | Term Insurance | No Limit |

*Disclaimer: We RenewBuy does not endorse any specific insurance company or insurance product offered by any insurer and this list is just an illustration of the plan offered by different life insurance companies

Insurance Companies offered Life Insurance Plans

There are 24 life insurance companies that offer life insurance plans in India, and each company has its own features and benefits. We have listed all 24 life insurance companies along with their claim settlement ratio and solvency ratio in the table below:

*Disclaimer: We RenewBuy does not endorse any specific insurance company or insurance product offered by any insurer and this list is just an illustration of the plan offered by different life insurance companies

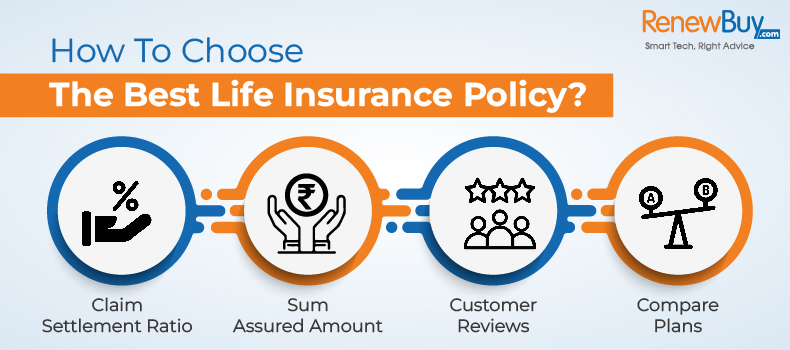

How to choose the best Life Insurance Policy?

With so many life insurance plans in the market, choosing the best life insurance policy in India can be very difficult. Everyone needs to know that based on what factors you should measure the life insurance policies available in India. We “RenewBuy” has made a list of a few pointers that will help you choose the best life insurance policy in India.

Assess your life goals

First of all, you need to do a self-evaluation by calculating your income and liabilities and determining your future goals. Since the circumstances are not pre-defined, hence set your life goals and plan best to attain them with security.

Choose the policy with the right coverage

In the list of life insurance policies, you can select the most appropriate policy that meets your future goals and present capabilities.

Sum Assured Amount

Check the sum assured amount offered under the life plan. Always go for a plan that offers a high and more sum assured option.

Prefer High Claim Settlement Ratio

First of all, you should check the claim settlement ratio of the insurance company. Life insurance companies with a high claim ratio will be the best to settle your claims when the time comes.

Customer Reviews

Customer reviews are the best ways to pick your life insurance plan. These reviews are posted by people who have the experience of how good is the particular plan.

Compare plans

Compare the different life insurance plans based on their coverage benefits. Life insurance companies have revolutionized their policies and are offering value-added features that enhance the benefits of the policy. Check for these value-added benefits so that you can choose the best life insurance plan for yourself.

What are the Life Insurance Riders & Its Benefits?

Life insurance riders are additional riders that enhance the basic coverage benefits offered under the base policy. There are different types of riders offered by life insurance companies, and each rider comes at an additional premium rate. You can choose to add the desired riders by paying an additional premium and making your coverage comprehensive. Some of the most common riders available with life insurance plans are as follows -

| Ride Name | Coverage Offered |

|---|---|

| Accidental Death Benefit Rider | The nominee will receive the sum assured amount along with some additional benefits by the life insurance company if the life assured dies in an accident. |

| Accidental Total and Permanent Disability Rider | In case of total or permanent disability due to an accident, all future premiums are waived off, and the insurance company pays some predefined amount to the policyholder. |

| Critical illness Rider | This rider covers specific critical illnesses. If the assured suffers from any of the critical illnesses listed in the policy document, then the insurance company pays a predefined sum amount to the policyholder and allows the policyholder to take the treatment without worrying about the finances. |

| Term Rider | This rider offers monthly income to the nominee on the death of the life assured. |

| Waiver of Premium Rider | This rider waives off the future premiums if the insured suffers permanent disablement due to an accident. |

| Surgical Rider | This rider pays the hospital expenses of the policyholder, if they undergo an avoidable surgery in India |

Factors Affecting Life Insurance Premium

We have mentioned in the table below the factors that are considered by the life insurance company in India and that affect the life insurance premium:

| Factors | How They Affect Life Insurance Premiums |

|---|---|

| Age | The older you are the higher would be the premium |

| Gender | There are sufficient research and evidence that proves that a female, on average, lives five years longer than a male. This ultimately affects the time period of the policy and lowers the premiums. |

| Sum Assured | The higher the sum assured you choose the higher would be the premium |

| Type of policy | The premium amount is different for the different types of life insurance plans. |

| Coverage benefits | The coverage benefits of a policy also change the premium. If the policy has inbuilt and comprehensive coverage benefits, then the premium of the policy will be a bit high. |

| Height and Weight | Your height and weight determine your BMI. If your BMI is higher or lower than the ideal, then you have to pay a high premium. |

| Medical History | If you have any existing medical complications or illnesses, then your premium might increase. |

| Family History | If you have a family history of illnesses or diseases, the premium might rise because such illnesses or diseases might be genetic and increase your mortality risk. |

| Occupation | If you are engaged in a dangerous occupation, the premium would be high. For example, people in the defence forces, police, politics, etc. are charged higher premiums. |

| Location | If you live in an area that is prone to natural disasters, the premium would be high. |

| Lifestyle Habits | Premiums are higher for individuals who smoke and/or consume alcohol and other intoxicating substances. |

| Riders selected | Life insurance plans to allow optional coverage benefits called riders. Each rider incurs an additional premium and so if you opt for any rider, the premium will increase. |

| Policy Discounts | Life insurance plans also allow premium discounts for different reasons. If you qualify for the discounts, the premium will be reduced. |

How to Save on Life Insurance Premium?

Saving on life insurance premiums can be beneficial for your overall financial planning. Remember, while saving on life insurance premiums, balancing affordability and adequate coverage is important to keep your loved ones financially secure. Here are some strategies to consider:

Compare Quotes

Compare quotes of different life insurance plans from different life insurance companies. Each company may have different rates, so you should explore your options and choose the one that offers the most affordable premiums for the coverage you need.

Choose Term Life Insurance

Term life insurance is more affordable than whole life or universal life insurance. It covers a specific term, such as 10, 20, or 30 years. Consider your needs and opt for term life insurance if it suits your circumstances.

Assess Your Coverage Needs

Evaluate the amount of coverage you require carefully. Opting for excessive coverage can lead to higher premiums. Determine your financial obligations, such as outstanding debts, mortgage, education expenses, and future income replacement, to arrive at an appropriate coverage amount.

Maintain a Healthy Lifestyle

Life insurance premiums are often based on your health and lifestyle factors. Maintaining a healthy lifestyle by exercising regularly, eating nutritious food, avoiding smoking or tobacco products, and moderating alcohol consumption can positively impact your premiums.

Start Early

Life insurance premiums increase as you age, so securing coverage as early as possible is wise. Locking in a policy at a younger age can help you access lower premiums.

Choose a Level-Term Policy

A level-term policy guarantees that your premiums remain the same throughout the policy term. This approach can help you avoid premium increases that may occur with policies that have adjustable premiums.

Consider Bundling Policies

Some insurance companies offer discounts if you bundle different policies together. For example, you could combine your life and auto or home insurance to receive a reduced policy premium.

Improve Your Credit Score

A good credit score can positively influence your life insurance premiums. Pay your bills on time, reduce your debt, and maintain a healthy credit history to potentially access lower rates.

Review and Update your Policy

Regularly review your life insurance policy to ensure it aligns with your current needs. Life changes, such as getting married, having children, or paying off debts, may warrant adjustments to your coverage. By keeping your policy up to date, you can avoid paying for unnecessary coverage.

Work with an Independent Agent

Consider consulting with an independent insurance agent who can help you navigate various insurance options. They can provide objective advice and assist you in finding the most cost-effective policy that suits your requirements.

Why Buy Life Insurance Policy From RenewBuy?

Besides the existence of multiple insurance providers in India, our valued consumers trust RenewBuy to buy life insurance policies for our simplified and exclusive offers available. We not only offer the best policy but makes you able to take the best decisions that complement your future goals and shield your family with financial security and stability. We are there to advise you at the time of clarifying the complicated terms and conditions and easing your claim process at your stiff times.

Best Experts

You can count on our trustworthy advisors near you, who keep your life priorities in the first place.

100% Assured

Get safe and reliable policies regulated by IRDAI.

24X7 Claim Assistance

Connect with our advisors to make your claim process hassle-free.

Instant Quotes

Once you plan to buy a policy, we list the appropriate plans instantly at the best prices. Just compare and save big.

Easy Renewals

Our simplified processes make it easy to renew your life insurance policy in the easiest way possible in no time.

How to Buy Life Insurance Policy From RenewBuy?

RenewBuy provides a quick and trusted platform where customers can compare and buy the best life insurance policy for themselves. Below mentioned are the steps to buying the best life insurance plan:

- Visit our website and click on the “Life Insurance” tab from the header menu.

- Then, click on the “View Plans” button.

- Enter the required information.

- Compare and pick the best premium plans from the list provided.

- Once the payment is made, you will get your policy documents on your registered email ID.

To make the life insurance buying process more convenient, connect with one of our RenewBuy POSP advisors and buy the best-suited life insurance plan as per your needs.

Documents required to Buy Life insurance Policy

The following are the required documents you need to submit to buy the best life insurance plans in India:

ID Proof

Voter ID, Driving License, PAN Card, Passport, or Aadhar Card.

Age Proof

10th or 12th mark sheet, Driving License, Passport, Birth Certificate, Voter ID, etc.

Address Proof

Telephone Bill, Ration Card, Electricity Bill, Driving License, and Passport.

Income Proof

Form 16, ITR (2-3 years), salary slips for the last 3 to 6 months, etc.

Life Insurance Claim Process

Life Insurance claim process is classified into two categories i.e. death claim process, and the maturity claim process. Let's discuss both the process in detail.

Death Claim Process

- Nominee should intimate the Life Insurance Company with all the required detail such as cause of death, time, and place.

- Submit all the needful documents such as the death certificate, and claim form.

- Submit the hospital, post-mortem, and doctor’s report.

- Once the insurance company completes its investigation, the insurer will settle the claim within 30 days of the documents being submitted by the insurer.

Maturity Claim Process

If the policyholder survives the policy term, then the insured is eligible to get benefits of maturity benefits. Below mentioned are the steps to file a maturity claim:

- The life insurance company will send a discharge voucher to the policyholder.

- The insured has to sign the voucher along with the original policy bond and send it back to the insurance company.

- The life insurance company will settle the claim and the claim amount will be sent to the assignee required documents